Interim report för Duni AB (publ) January 1 - March 31, 2022

January 1 – March 31

- Net sales amounted to SEK 1,443 m (932), corresponding to a 54.8% increase in sales. Adjusted for exchange rate movements, net sales increased by 49.3%.

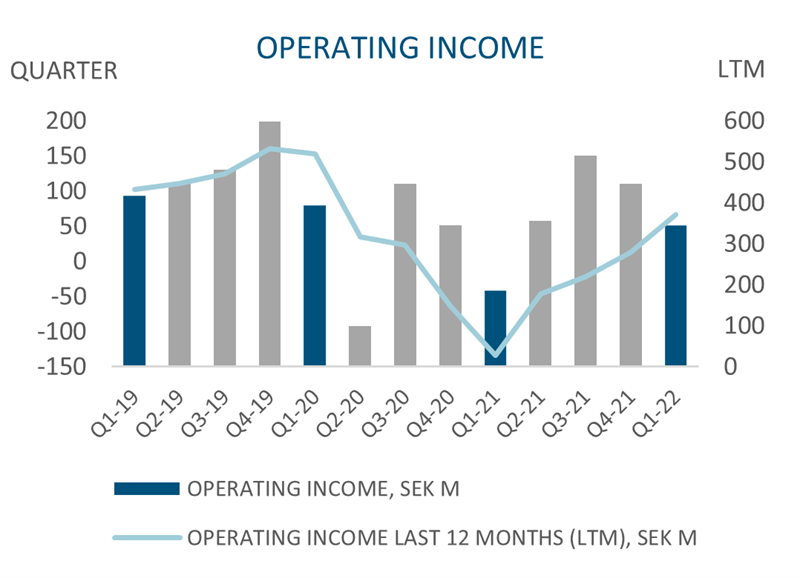

- Fewer limiting restrictions lead to higher sales and improved earnings, mainly through better absorption of fixed costs within the Duni business area. Operating income was SEK 51 m (-41).

- Continued strong growth in the BioPak business area, primarily in Australia. However, a high-cost pressure gives lower margins.

- Price increases have been implemented with a gradual increase in impact during the quarter.

KEY FINANCIALS

| SEK m | 3 months Jan-Mar 2022 | 3 months Jan-Mar 2021 | 12 months Apr-Mar 21/22 | 12 months Jan-Dec 2021 |

| Net sales | 1,443 | 932 | 5,572 | 5,061 |

| Organic growth | 49.3% | -22.9% | 32.9% | 14.4 % |

| Operating income 1) | 51 | -41 | 371 | 279 |

| Operating margin 1) | 3.6% | -4.4% | 6.7% | 5.5 % |

| EBIT | 26 | -56 | 255 | 173 |

| EBIT margin | 1.8% | -6.1% | 4.6% | 3.4% |

| Income after tax | 6 | -51 | 134 | 77 |

| Earnings per share after dilution | 0.11 | -1.11 | 2.84 | 1.62 |

| Income after financial items | 12 | -72 | 218 | 133 |

| Return on capital employed, excluding goodwill | 16.1% | 1.4% | 16.1% | 14.4% |

1) For reconciliation of alternative key financials, definitions of key financials and glossary, see pages 28-30.

CEO's comment

Sales growth of 55% in the first quarter

The restrictions introduced during the fourth quarter of 2021 have to some extent followed into this year’s first quarter. Many markets have gradually opened up, but Germany and Benelux continued to have strict restrictions during the first two months of the year. The clear correlation between reduced sales and restrictions, regulated opening hours and closures that we have seen earlier during the pandemic was once again reminded. During March, demand and therefore sales increased, which confirms the signs we have seen of a rapidly recovering market.

Group sales for the quarter amounted to SEK 1,443 m (932). At fixed exchange rates, this corresponds to a sales increase of 49.3%. Sales compared to the first quarter of 2019 increased by 14%.

The Duni business area was affected by another quarter of restrictions. Despite this, sales increased by 100% compared to the first quarter of 2021, however the restrictions were tougher in 2021 than in this year.

The BioPak business area continues to benefit from the growing take-away market and increases sales by 16.2%, at fixed exchange rates, compared to the first quarter of 2021. The Australian market in particular is showing strong growth.

Improved operating income despite cost pressures

The price increases previously announced have begun to be implemented, which, together with volume recovery, contributes to an increase in gross margins compared to 2021, but not yet in line with 2019. The increasing inflation and the general uncertainty in the market mean that further price increases may be necessary. The operating income for the quarter showed a clear improvement compared with the same period last year and amounted to SEK 51 m (-41). It is the Duni business area that contributes to the improvement and increases operating income by above SEK 100 m to SEK 21 m (-83). The operating income of the BioPak business area decreased to SEK 31 m (43), which is largely due to increased freight and energy costs, which are pushing margins in the short term, and which have not yet been fully compensated. To secure deliveries to customers, we have increased inventory, especially within BioPak, which reflects the uncertainty we see in the supply of goods and components. We therefore feel that we are in a good position to be able to supply the market with products.

Uncertain situation

The geopolitical situation in Europe following the invasion of Ukraine has marked the quarter. We are deeply concerned about the situation and our thoughts are with everyone affected. The Group supports UNHCR and provides food and beverage products to refugee camps in Poland. As previously announced, we made an early decision to stop all deliveries to Russia and have during the quarter worked intensively to close our business there in a responsible way. The divestment entails a restructuring cost of approximately SEK 9 m, burden earnings for the first quarter.

Despite continued market unrest, we are experiencing a normalization of demand as a result of easing restrictions, and we look forward with confidence to spring and summer. We are continuing our work toward our three sustainability targets and our vision of becoming fully circular with a net zero carbon emissions for Scope 1 & 2, and in line with science- based targets for Scope 3 by 2030. During the quarter we have installed solar cells at our facility in Bramsche, Germany. Now electricity is also being supplied from Bra Miljöval Vind to the paper mill in Skåpafors.

Robert Dackeskog, President and CEO, Duni Group.

::

For more information, please contact:

Robert Dackeskog, President and CEO, +46 (0)40 10 62 00

Magnus Carlsson, CFO, +46 (0)40 10 62 00

Helena Haglund, Group Accounting Manager, +46 (0)734 19 63 04

Duni AB (publ)

Box 237

SE-201 22 Malmö

Phone: +46 (0)40 10 62 00

www.dunigroup.com

Company registration number: 556536-7488

::

Duni Group is a market leader in attractive, environmentally sound, and functional products for table setting and take-away. The Group markets and sells two brands, Duni and BioPak, which are represented in more than 40 markets. Duni Group has around 2,200 employees in 22 countries, its headquarters in Malmö and production units in Sweden, Germany, Poland, New Zealand and Thailand. Duni is listed on the NASDAQ Stockholm under the ticker name “DUNI”. ISIN code is SE0000616716. This information is information that Duni AB is obligated to make public pursuant to the EU Market Abuse Regulation. The information was provided, through the contact person, for publication on April 22, 2022 at 07:45 CET.