Interim report för Duni AB (publ) January 1 - June 30, 2022

April 1 – June 30

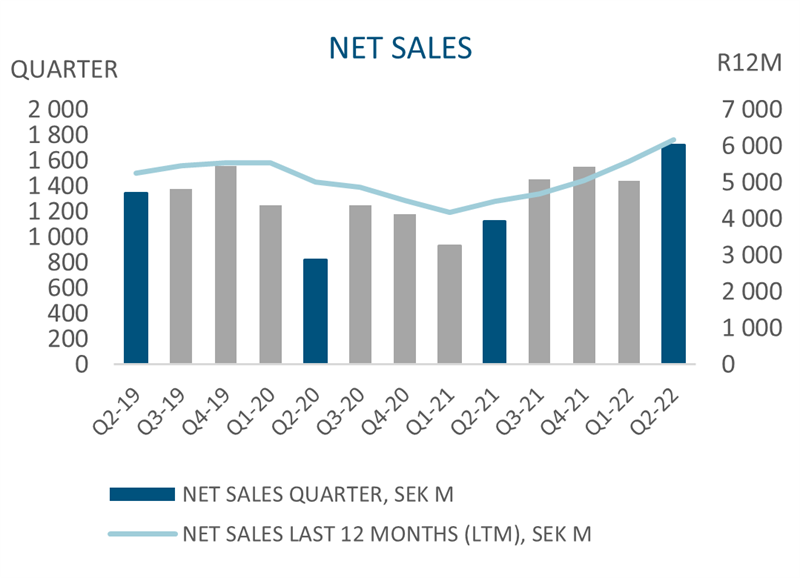

- Net sales amounted to SEK 1,724 m (1,124), corresponding to a 53.4% increase in sales. Adjusted for exchange rate movements, net sales increased by 47.1%.

- Operating income was SEK 91 m (58).

- Increased demand leads to a good recovery for the Duni business area and continued growth for BioPak.

- Margins are pressured from significant cost pressure, which is continuing to increase into the third quarter.

- A clear underlying improvement in income compared with the previous year, which included major government support during the pandemic.

KEY FINANCIALS

| SEK m | 3 months Apr-Jun 2022 | 3 months Apr-Jun 2021 | 6 months Jan-Jun 2022 | 6 months Jan-Jun 2021 | 12 months Jul-Jun 21/22 | 12 months Jan-Dec 2021 |

| Net sales | 1,724 | 1,124 | 3,167 | 2,056 | 6,172 | 5,061 |

| Organic growth | 47.2% | 40.7% | 48.1% | 2.4% | 35.2% | 14.4% |

| Operating income 1) | 91 | 58 | 142 | 18 | 404 | 279 |

| Operating margin 1) | 5.3% | 5.2% | 4.5% | 0.9% | 6.5% | 5.5% |

| EBIT | 67 | 43 | 93 | -14 | 279 | 173 |

| EBIT margin | 3.9% | 3.8% | 2.9% | -0.7% | 4.5% | 3.4% |

| Income after financial items | 60 | 34 | 72 | -38 | 243 | 133 |

| Income after tax | 49 | 18 | 55 | -33 | 165 | 77 |

| Earnings per share after dilution | 1.02 | 0.38 | 1.13 | -0.73 | 3.48 | 1.62 |

| Return on capital employed, excluding goodwill | 16.7% | 8.9% | 16.7% | 8.9% | 16.7% | 14.4% |

1) For reconciliation of alternative key financials, definition of key financials and glossary, see pages 31–33.

CEO's comment

Sales growth of 53% in the second quarter

Now that most restrictions have been eased, we are seeing a strong recovery in the HoReCa market. This has led directly to a recovery in sales, albeit with some delay, as for example Germany maintained its restrictions for longer than other countries. All regions grew during the quarter, with the Central region standing out with growth of 77.8% at fixed exchange rates. The industry is currently being challenged by staff shortages, which in many places is resulting in limited opening hours and seating capacity.

Group sales amounted to SEK 1,724 m (1,124). At fixed exchange rates, this corresponds to a sales increase of 47.1%. Sales compared with the second quarter of 2019 rose by 27% in the same currency.

The Duni business area increased by 85% at fixed exchange rates, compared with the same period last year. The biggest increase comes from the hotel and restaurant industry, where Duni grew by 130%, which is due to eased restrictions resulting in increased volumes, but also due to price increases.

The BioPak business area grew by 16% due to price increases and some growth. In connection with eased restrictions, the number of events, parties and catering occasions is increasing, causing an increase in demand for cups, glasses, and cutlery.

Improved operating income, despite cost pressure

Operating income for the quarter showed a clear improvement compared with the same period last year and amounted to SEK 91 m (58). The Duni business area in particular contributed to the improvement, increasing its operating income to SEK 71 m (-3). Operating income for the BioPak business area decreased to SEK 20 m (62). This decline is driven primarily by increased inventory costs and high freight and energy costs, which have not yet been compensated for by price increases.

We continue to have a good delivery situation, although the gross margin is under pressure from cost increases. Price increases for the quarter amounted to approximately SEK 115 m, but do not fully compensate for the strong inflationary pressure that is now taking effect. Additional price increases have been announced and are expected to take full effect from January 2023. Despite the turbulent geopolitical situation, resulting in strong inflation, we see normalized demand at the level of 2019.

During the quarter, on behalf of the Board of Directors, we took further steps in the process of evaluating various strategic alternatives in order to optimize the long-term value of BioPak Pty Ltd and its subsidiary, “BioPak Group”.

Initiatives for a more sustainable future

We are continuing our work towards our three sustainability goals and our vision of becoming fully circular with net zero carbon emissions for Scope 1 & 2, and in line with science-based targets for Scope 3 by 2030. During the quarter, among other things, we completed our report to the UN Global Compact, as a member of their “Early Adopter” program. We have also ensured standardized sizes of outer packaging, which enables more products per pallet, a more efficient logistics chain and less climate impact. In addition, we have increased our investment in solar cells, this time at our production unit in Bangkok, Thailand. We have also launched a project to measure our Scope 3 impact, which is an important piece of the jigsaw in achieving our sustainability targets. Finally, I am pleased to announce that 17 colleagues have chosen to become sustainability ambassadors. Once they have completed their training, they will support and motivate the organization to work even better around/with sustainability.

Robert Dackeskog, President and CEO, Duni Group

::

For more information, please contact:

Robert Dackeskog, President and CEO, +46 (0)40 10 62 00

Magnus Carlsson, CFO, +46 (0)40 10 62 00

Helena Haglund, Group Accounting Manager, +46 (0)734 19 63 04

Duni AB (publ)

Box 237

SE-201 22 Malmö

Phone: +46 (0)40 10 62 00

www.dunigroup.com

Company registration number: 556536-7488

::

The Duni Group is a market leader in attractive, environmentally sound and functional products for table setting and take-away. The Group markets and sells two brands, Duni and BioPak, which are represented in more than 40 markets. Duni has around 2,200 employees in 21 countries, its headquarters in Malmö and production units in Sweden, Germany, Poland, New Zealand and Thailand. Duni is listed on the NASDAQ Stockholm under the ticker name “DUNI”. Its ISIN code is SE0000616716. This information is information that Duni AB is obligated to make public pursuant to the EU Market Abuse Regulation and the Securities Market Act. The information was submitted for publication, through the agency of the contact person set out above, at 12:00 CET on July 15, 2022.